Sacrifice pre-tax salary into super

Contributing some of your pre-tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement.

How does the strategy work?

With this strategy, known as salary sacrifice, you need to arrange for your employer to contribute some of your pre-tax salary, wages or bonus directly into your super fund.

The amount you contribute will generally be taxed at the concessional rate of 15%1, not your marginal rate which could be up to 47%2.

Depending on your circumstances, this strategy could reduce the tax you pay on your salary, wages or bonus by up to 32%. Also, by paying less tax, you can make a larger after-tax investment for your retirement, as the below case study illustrates.

What income can be salary sacrificed?

You can only sacrifice income that relates to future employment and entitlements that have not been accrued.

With salary and wages, the arrangement needs to be in place before you perform the work that entitles you to the salary or wages.

With a bonus, the arrangement needs to be made before the bonus entitlement is determined. The arrangement, which should be documented and signed by you and your employer, should include details such as the amount to be sacrificed into super and the frequency of the contributions.

Other key considerations

- Salary sacrifice contributions count towards the ‘concessional contribution’ cap. This cap is $27,500 in FY 2022/23, or may be higher if you didn’t contribute your full concessional contribution cap since 1 July 2018 and are eligible to make ‘catch-up’ contributions. Tax implications and penalties apply if you exceed your cap.

- You can’t access super until you meet certain conditions.

- Another way you may be able to grow your super tax-effectively is to make personal deductible contributions (see below).

Seek advice

Contact us to speak to a financial adviser who can help you determine whether salary sacrifice suits your needs and circumstances.

Case study

William, aged 45, was recently promoted and has received a pay rise of $5,000, bringing his total salary to $90,000 pa.

He plans to retire in 20 years and wants to use his pay rise to boost his retirement savings.

After speaking to a financial adviser, he decides to sacrifice the extra $5,000 salary into super each year.

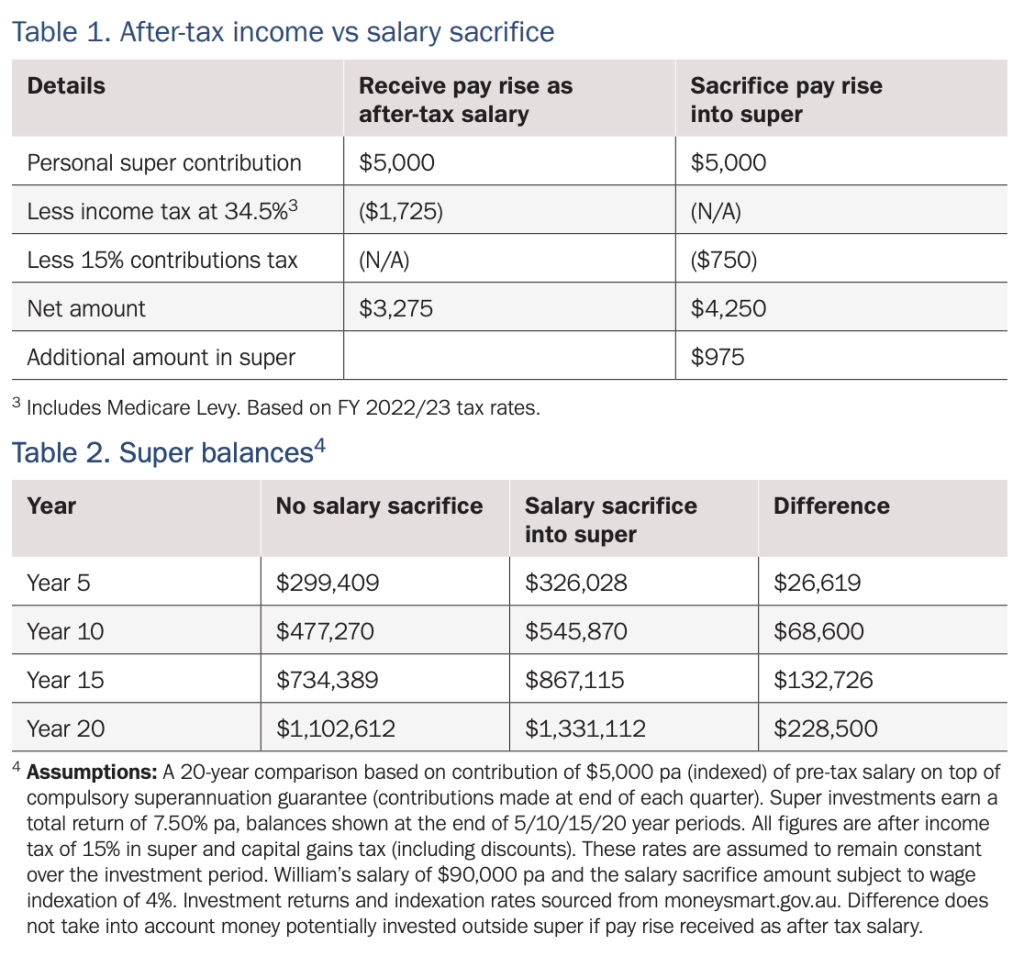

By using this strategy, he’ll save on tax and have an extra $975 in the first year to invest into super, when compared to receiving the $5,000 as after-tax salary (see Table 1).

If he continued to salary sacrifice this amount into super, this could lead to William having an additional $228,500 in his super after 20 years (see Table 2).

Personal Deductible Contributions

Like salary sacrifice, making a personal super contribution and claiming a tax deduction may enable you to boost your super tax-effectively. There are, however, a range of issues you should consider before deciding to use this strategy.

Your financial adviser can help you determine whether you should consider making personal deductible contributions instead of (or in addition to) salary sacrifice.

You may also want to ask your financial adviser for a copy of our super strategy card, called ‘Make tax-deductible super contributions’.

1 Individuals with income above $250,000 pa will pay an additional 15% tax on personal deductible and other concessional super contributions.

2 Includes Medicare Levy.

Important information and disclaimer

This document has been prepared by Actuate Alliance Services Pty (ABN 40 083 233 925, AFSL 240959) (Actuate), a related entity of Insignia Financial Ltd ABN 49 100 103 722. The information in this document is factual in nature. It reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue (27 March 2023), and may be subject to change. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Examples are illustrative only and are subject to the assumptions and qualifications disclosed. Past performance is not a reliable indicator of future performance, and it should not be relied on for any investment recommendation. To the extent that the information in the document contains general advice, it has been prepared without considering any person’s individual objectives, financial situation or needs. You should consider the appropriateness of the general advice in light of your own objectives, financial situation or needs.

This document is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of Actuate. Whilst care has been taken in preparing the content, no liability is accepted by Actuate or any member of the Insignia Financial group, nor their agents or employees for any errors or omissions in this document, and/or losses or liabilities arising from any reliance on this document.