Top-up your super with help from the Government

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Government co-contribution and take advantage of the low tax rate payable in super on investment earnings.

How does the strategy work?

If you earn¹ less than $57,016 pa (of which at least 10% is from eligible employment or carrying on a business) and you make personal after-tax super contributions, the Government may also contribute into your super account.

This additional super contribution, which is known as a co-contribution, could make a significant difference to the value of your retirement savings over time.

To qualify for a co-contribution, you will need to meet a range of conditions, but as a general rule:

• the maximum co-contribution of $500 is available if you contribute $1,000 and earn $42,016 or less

• a reduced amount may be received if you contribute less than $1,000 and/or earn between $42,017 and $57,016, and

• you will not be eligible for a co-contribution if you earn $57,017 or more.

The Australian Taxation Office (ATO) will determine whether you qualify based on the data received from your super fund and the information contained in your tax return for that financial year.

As a result, there can be a time lag between when you make your personal after-tax super contribution and when the Government pays the co-contribution.

If you’re eligible for the co-contribution, you can nominate which fund you would like to receive the payment. Alternatively, if you don’t make a nomination and you have more than one account, the ATO will pay the money into one of your funds based on set criteria.

Note: Some funds or superannuation interests may not be able to receive co-contributions. This includes unfunded public sector schemes, defined benefit interests, traditional policies (such as endowment or whole of life) and insurance only superannuation interests.

Other key considerations

• You can’t access super until you meet certain conditions.

• You may want to consider other ways to contribute to super, such as salary sacrifice or personal deductible contributions.

Seek advice

Contact us to speak to a financial adviser who can help you determine whether you should make personal super contributions and assess whether you will qualify for a Government co-contribution.

Case study

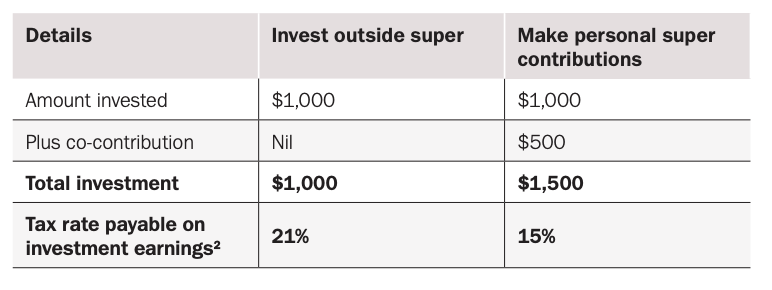

Ryan, aged 40, is employed and earns $35,000 pa. He wants to build his retirement savings and can afford to invest $1,000 a year.

After speaking to a financial adviser, he decides to use the $1,000 to make a personal after-tax super contribution. By using this strategy, he’ll qualify for a co-contribution of $500 and the investment earnings will be taxed at a maximum rate of 15%.

Conversely, if he invests the money outside super each year (in a managed fund, for example), he will not qualify for a co-contribution and the earnings will be taxable at his marginal rate of 21%².

¹ Includes assessable income, reportable fringe benefits and reportable employer super contributions, less business deductions and assessable First Home Super Saver amounts. Other conditions apply.

2 Includes Medicare Levy.

Important information and disclaimer

This document has been prepared by Actuate Alliance Services Pty (ABN 40 083 233 925, AFSL 240959) (Actuate), a related entity of Insignia Financial Ltd ABN 49 100 103 722. The information in this document is factual in nature. It reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue (27 March 2023), and may be subject to change. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Examples are illustrative only and are subject to the assumptions and qualifications disclosed. Past performance is not a reliable indicator of future performance, and it should not be relied on for any investment recommendation. To the extent that the information in the document contains general advice, it has been prepared without considering any person’s individual objectives, financial situation or needs. You should consider the appropriateness of the general advice in light of your own objectives, financial situation or needs. This document is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of Actuate. Whilst care has been taken in preparing the content, no liability is accepted by Actuate or any member of the Insignia Financial group, nor their agents or employees for any errors or omissions in this document, and/or losses or liabilities arising from any reliance on this document.